General Information

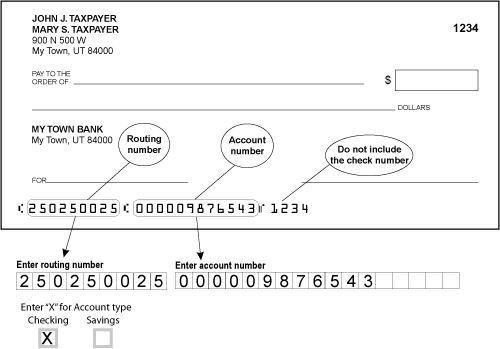

If you want your refund (or remaining refund) deposited directly into your checking or savings account, enter your bank or credit union’s routing number and your account number. Do not include hyphens, spaces or special symbols.

See the Direct Deposit Example below to find the routing and account numbers on your check. Your financial institution can also provide this information.

Indicate whether you want your refund deposited into your checking or savings account, or if the account is foreign (outside of the United States or its territories). We cannot transfer funds outside of the United States, so if you mark “foreign” you will receive your refund as a check.

If we cannot direct deposit your refund we will mail you a refund check to the address on your return.

You can also choose direct deposit if you use Taxpayer Access Point to file your return.